by Yogi Nelson

Welcome to the BlockchainAIForum

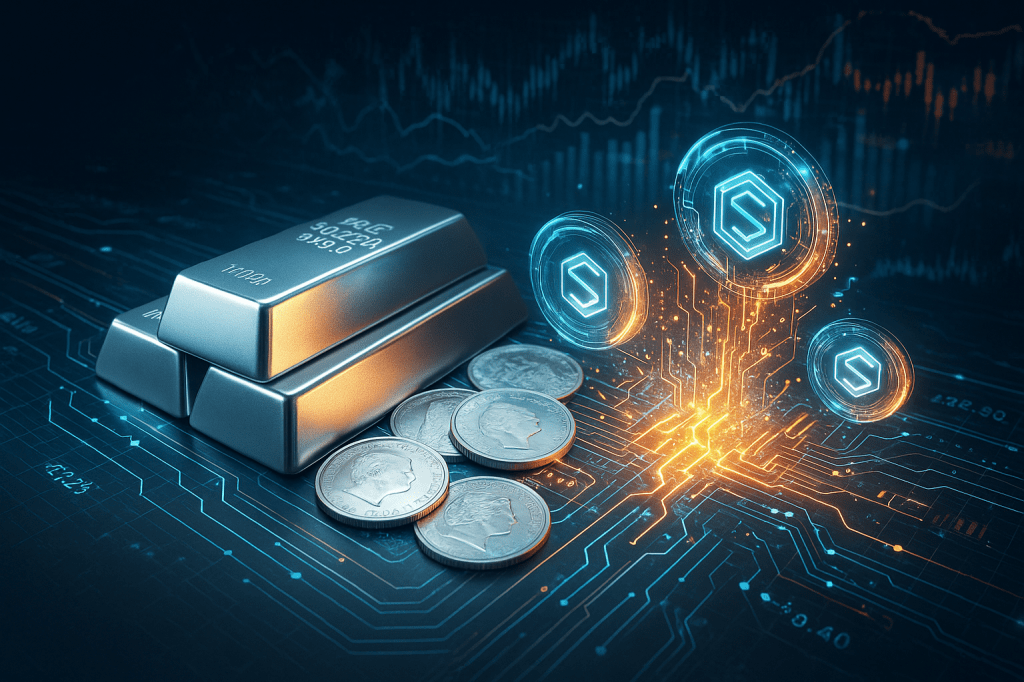

Gold has captured the attention of the Real World Asset (RWA) market, but silver—its undervalued little sister, that is both money and industrial metal, is quietly entering the blockchain era. Listen, tokenized silver is no longer a distant idea. It already exists, with several companies offering blockchain-based silver tokens backed by physical metal. The real question now is “how big will this market become, and how soon?” That’s why I want to share what tokenized silver is, who’s doing it, why it matters, and when it might enter mainstream adoption.

What Is Tokenized Silver?

Tokenized silver is a digital representation of real, vaulted silver on a blockchain. Each token ideally reflects:

– One ounce (or gram) of physical silver

– Stored securely in audited vaults

– Fully redeemable

– Instantly transferable across borders

The total tokenized silver market currently sits around $180–190 million—small, but no longer hypothetical. The overall tokenized precious-metals sector is estimated above $1 billion and growing.

Silver Tokenizers Step Forward and Reveal Yourself!

1. Kinesis Silver (KAG)

Each KAG token is backed by one ounce of physical silver. Kinesis stores the metal in audited, insured vaults worldwide. It aims to reintroduce silver-backed currency in modern digital form.

2. SilverToken (SLVT)

SLVT represents ownership of physical silver held in multiple privately owned vaults. Tokens are redeemable for real silver or convertible back into USDC. A portion of transaction fees buys additional silver to strengthen backing.

3. Wealth99 Silver Token

Each token represents one ounce of silver, with full physical backing and vault guarantees. Wealth99 emphasizes fractional ownership, allowing very small purchase sizes.

4. Ainslie Bullion – AGS Token

AGS is backed by one gram of vaulted silver and is part of a larger suite of tokenized metals. It’s popular in Australia as a gateway to fractional precious-metal ownership.

These platforms are all operating, audited, and offering real metal-backed digital assets right now.

Why Tokenize Silver?

There are several compelling reasons:

1. Silver’s Dual Role: Industrial + Monetary

Silver is both an industrial workhorse (solar, electronics, medical applications) and a centuries-old monetary metal, dating back to the Romans. Tokenization blends these strengths with the technology of blockchain.

2. Fractional Ownership and Liquidity

Tokenized silver allows:

– Borderless trading

– Fractional ownership (as little as 0.01 oz)

– 24/7 liquidity

– Integration with DeFi lending and collateral systems

3. Transparency and Auditability

Many projects publish vault audits, proof-of-reserves, and on-chain issuance logs. For investors skeptical of “paper silver,” this transparency is an upgrade but no replacement for physical possession.

Challenges and Risks

1. Custody and Counterparty Risk

The biggest question: can the token truly be redeemed for silver? Answer–everything hinges on proper vaulting, insurance, and legal clarity.

2. Regulation

Tokenized silver sits at the intersection of commodities, securities regulation, and crypto law. Does this slow institutional adoption? Yes. However, now that the SEC and CFTC are pro-innovations, there is room for optimism.

3. Liquidity

Full disclosure–current liquidity is modest. Tokenized silver is a fraction of the global silver market. Trading depth must increase before large institutional flows are possible.

So… When Will Tokenized Silver “Arrive”?

Technically, it already has. The infrastructure is live. But mainstream adoption will depend on:

– Regulation

– Institutional custodians adopting tokenized metals

– On-chain liquidity and exchange support

– Integration into DeFi collateral markets

0–3 Year Outlook

– More exchanges list silver-backed tokens

– Better on-chain audits and redemption pathways

– Improved liquidity

3–5 Year Outlook

– Institutional-grade silver-backed stablecoins

– Multi-metal baskets (gold + silver + copper)

– Cross-market tokenized commodities funds

Silver tokenization is moving from experimental to established. The next phase will focus on scale, regulation, and trust.

Time to Go But First a Final Thought

Tokenized silver is not science fiction. It exists, it’s working, and companies like Kinesis (KAG), SilverToken (SLVT), Wealth99, and Ainslie’s AGS are proving the model today. Its future depends on expanding liquidity, strengthening trust, and building regulatory clarity. As the RWA sector matures, silver could become a foundational asset class on the blockchain—providing a bridge between industrial demand, physical scarcity, and digital programmability. For investors who appreciate both hard assets and blockchain efficiency, tokenized silver could become a powerful hybrid store of value.

Until next time

Yogi Nelson

Sources

– Tokenized Silver Market Cap Estimates (Various trackers)

– Kinesis Silver (KAG) – Company Disclosures & Vaulting Information

– SilverToken (SLVT) – Official Documentation & Audit Reports

– Wealth99 Silver – Token Issuer Details

– Ainslie Bullion AGS – Token Whitepaper and Custody Notes

– Tokenized Precious Metals Market Size Reports (2023–2024)