by Yogi Nelson

For hundreds of years, perhaps more, silver has lived in gold’s long shadow as a store of value. That’s why some folks call silver “poor man’s gold”. Silver stackers don’t mind being called “poor”. Lol! And yes, it’s true silver is more volatile than gold. And it’s also true silver has often been overlooked except during brief moments of speculative frenzy. Fine. But the question we face today is what will tokenized silver mean for utility, value, use, and price? Since tokenized silver is clearly a possibility, let’s explore all those questions and more. Remember, tokenized silver is not merely about price appreciation. It is about structure, accessibility, industrial relevance, and a monetary metal finally finding a digital form that suits its dual identity.

Silver’s Dual Personality: Money and Machine

Silver is unique among precious metals because it straddles two worlds. On one side, it is a monetary metal with thousands of years of history as coinage, savings, and settlement. On the other, it is an industrial metal embedded in the modern economy—electronics, solar panels, medical devices, electric vehicles, and advanced manufacturing all depend on it. A combo all investors love.

This dual role has long complicated silver’s investment narrative. Gold is a safe haven; it often thrives when fear rises and trust erodes. Silver responds to monetary stress, industrial cycles, technological adoption, and supply bottlenecks. The result is volatility—sometimes dramatic, sometimes punishing. For instance, in 1980 silver surged to $50 only to crash to $10 by 1982.

Yet that same complexity makes silver a natural candidate for tokenization. Does a blockchain ask whether an asset is “purely monetary” or “purely industrial?” Nope. Blockchains only ask whether ownership can be clearly defined, transparently recorded, and efficiently transferred. Silver checks every box. Read on, to understand why silver lagged gold in tokenization.

Why Silver Lagged Gold in Early Tokenization

Destiny ensured that gold was always going to be tokenization’s first success in the metals space. Central banks hold it. Vaulting standards are globally harmonized. The market is deep, liquid, and culturally entrenched. In other words, silver can’t compete with gold’s resume. Moreover, unlike gold, silver production is a by-product of other mining activities. While silver has a greater retail base, which means coins are preferred, industrial users care about delivery timing and purity specifications rather than symbolism.

Early tokenization projects prioritized simplicity and that gave gold the advantage. One token equals one ounce of vaulted gold, audited and insured. Silver’s logistical reality—greater bulk, higher storage costs per dollar of value, and more complex industrial flows—made it a less obvious starting point. But tokenization technology has matured. Smart contracts now accommodate fractional ownership, batch settlement, and multi-use claims. Custody providers have expanded their silver vaulting capabilities. What once looked like friction now looks like opportunity.

The Industrial Case for Tokenized Silver

Silver’s industrial demand is no longer a footnote; it is the headline. Solar energy alone consumes a meaningful and growing share of global silver supply. Each photovoltaic panel requires silver paste for conductivity. As nations push for electrification, grid upgrades, and renewable deployment, silver demand becomes structural rather than cyclical. It may sound unbelievable, but true–there are hundreds of millions of people around the world without reliable electricity. They want it, and silver is required.

Tokenization introduces a powerful new mechanism here. Industrial users can hedge future silver needs using tokenized inventory. Manufacturers can settle supply contracts on-chain. Producers can tokenize output before it leaves the ground, creating pre-financing structures that reduce reliance on debt.

This is where silver begins to differentiate itself from gold in the RWA universe. Gold is stored. Detractors say it only collects dust. Silver is used. Tokenization allows the same ounce to move fluidly between investment, collateral, and consumption states without leaving the digital ledger.

Accessibility: Silver’s Hidden Advantage

Gold’s price per ounce (about $4,400) is both a strength and a barrier. It conveys seriousness, but limits participation to the wealthy. Silver’s lower unit cost makes it inherently more accessible to the 99%—especially when paired with fractionalized tokens.

For younger investors, emerging-market savers, and on-chain participants accustomed to granular positions, tokenized silver feels intuitive. It aligns with the ethos of decentralized finance: small units, high velocity, global reach. This accessibility matters. Tokenization is not only about efficiency; it’s also about democratization. Silver has always been the people’s metal. Tokenization creates a 21st century distribution channel to the natural union of silver and blockchain.

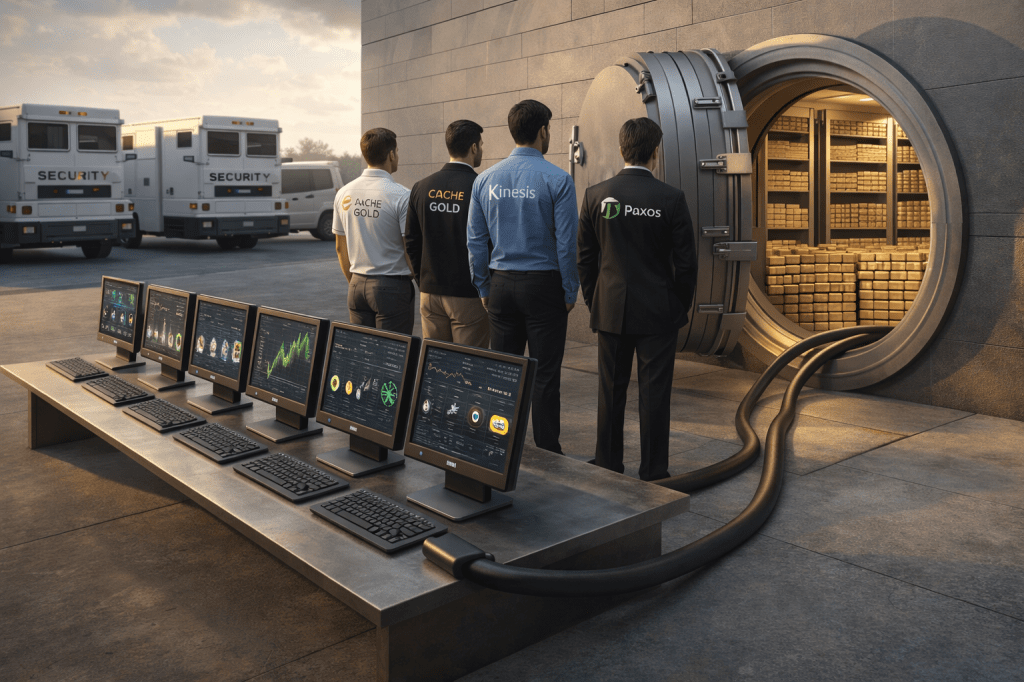

Trust, Custody, and the Importance of Standards

Let’s be honest, no discussion of tokenized metals is complete without addressing trust. The promise of tokenization collapses if the underlying metal is not real, allocated, and verifiable. Tokenization adheres to the old Russian proverb: trust but verify.

Silver investors, perhaps more than gold investors, are acutely aware of paper claims, re-hypothecation, and opaque inventories. Are the Commodities Exchange (COMEX) and the London Bullion Market Association (LBMA) trustworthy institutions? Silver investors wary; hence, they will gravitate to a technology based on zero trust where independent audits, clear redemption rights, and transparent reporting are transparent and the industry standards. Tokenization embeds the standards into code. This is big!

Here is the takeaway: The winners in this space will be those who understand that blockchain is a trust amplifier, not a trust substitute.

Monetary Reset Narratives and Silver’s Optionality

Plain and simple, gold dominates conversations about monetary reset, de-dollarization, and central-bank accumulation. Silver is rarely mentioned in the same breath, yet history tells a more nuanced story. For centuries, silver was money—not a derivative of gold, but a parallel standard. In fact, in the U.S. Constitution, Article 1, Section 10, Clause 1, says: “No State shall … make any thing but gold and silver coin a tender in payment of debts.” That was then what about now? India, the world’s most populous nation, has announced its bank can accept silver as collateral. Some things never go out of fashion!

In a world where sovereign currencies face structural debt burdens and confidence erosion, silver’s optionality becomes valuable. It offers monetary exposure with embedded industrial demand. Tokenization enhances this optionality by making silver portable, programmable, and interoperable with digital financial systems.

If gold is the anchor, silver may be the bridge.

Silver vs. Gold Tokens: Complement, Not Competition

It is tempting to frame tokenized silver as a challenger to tokenized gold. That framing misses the point. These assets serve different functions within a tokenized portfolio.

Gold tokens excel as long-term reserves, collateral for large settlements, and institutional balance-sheet assets. Silver tokens shine in liquidity, payments experimentation, industrial hedging, and retail participation. Together, they form a digital precious-metals stack that mirrors their historical relationship—distinct, complementary, and mutually reinforcing.

In this sense, silver’s underdog status becomes an advantage. It is not burdened by expectations of perfection. It is free to innovate, and innovators change the world.

Risks and Realism

No asset story is complete without acknowledging risk. Silver remains volatile. Industrial demand can fluctuate. Tokenization introduces regulatory complexity, especially across jurisdictions. Custody failures or poorly designed token structures could undermine confidence.

Moreover, tokenized silver must avoid the trap of becoming merely “paper silver on a blockchain.” Without clear redemption mechanisms and enforceable legal claims, digital representations add little value. Yet these risks are not unique to silver. They are the growing pains of an emerging asset class. What matters is design discipline.

Conclusion

Is 2026 the year tokenized silver breaks out? I conclude yes, because of three powerful forces: 1) the long-term digitization of assets trend; 2) will electrification of the global economy march forward; 3) and the search for trustworthy stores of value outside fragile monetary systems. If those powerful forces occur, tokenized silver begins in 2026.

Until next time,

Yogi Nelson

*** This article is part of an ongoing weekly series examining the tokenization of precious metals—covering custody, standards, regulation, issuer structure, settlement infrastructure, and market design. The series is published on BlockchainAIForum and LinkedIn and is among the few sustained, multi-metal editorial projects focused on tokenized metals as financial infrastructure rather than product promotion.