Exploring the Past, Present, and Future of Public Sector Innovation

by Yogi Nelson

Welcome to the BlockchainAIForum

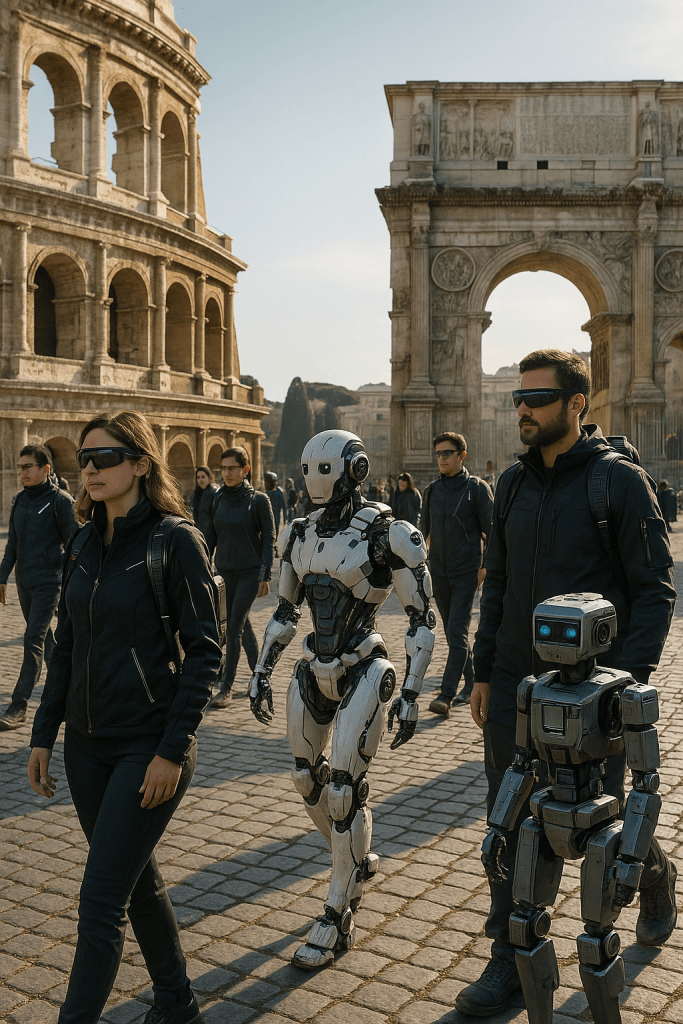

A Digital Renaissance in the Italian Government

I post this article in honor of Italy from the great city of Milan, Italy! Unbelievable! Italy, a country known for its ancient traditions and rich cultural legacy, is undergoing a quiet digital revolution. I’m hoping to see it and much more. In recent years, the Italian government has embraced blockchain technology not just as a buzzword, but as a functional tool to modernize its public sector. From notarization services to education credentials, Italy is leveraging blockchain for transparency, efficiency, and trust.

📜 A Timeline of Blockchain Adoption in Italy

2018: First Steps

Italy became one of the first European Union countries to formally define blockchain in law. In 2019, the government issued a decree recognizing the legal validity of digital records stored on blockchain—a foundational move that paved the way for official use.

2020–2022: Strategic Framework

The Italian Ministry for Economic Development (MiSE) launched a Task Force on Distributed Ledger Technologies, laying out strategies to promote public-private blockchain initiatives. It also joined the European Blockchain Partnership (EBP), a consortium working toward a cross-border blockchain infrastructure.

🧾 Use Case: Blockchain for Notarization

One of the earliest blockchain applications adopted by the Italian government is document time stamping and notarization. Using blockchain, Italians can certify ownership, creation dates, and authenticity of documents without going through traditional notary services. This includes contracts, intellectual property, and even digital art. In Puerto Rico, where I live, our legal system, shares, and suffers from, many of the same antiquated notarization system. Its awful.

Key Player: Blockchain Italia.io

In collaboration with municipal governments, Blockchain Italia developed Dedit.io, a blockchain-based notarization platform now used by various public entities for legal proof and traceability.

🎓 Use Case: Education Credentials

The University of Cagliari partnered with the Italian Ministry of Education to launch a pilot program that issues blockchain-verified diplomas and academic records. This model is now being reviewed for nationwide rollout, potentially replacing traditional paper certificates.

Benefits include:

– Instant verification of credentials for employers and foreign institutions

– Tamper-proof and accessible from anywhere

– Reduces fraud and administrative overhead

🏛️ Use Case: Public Procurement Transparency

Italy has a long-standing battle against corruption and opaque procurement practices. Blockchain is offering new tools to digitize and audit public contracts.

Pilot Projects:

– Veneto Region initiated a blockchain-based procurement pilot to digitally track bidding processes and vendor compliance.

– Blockchain systems help ensure that once a public tender is published, terms cannot be altered, increasing trust among vendors.

🖼️ Use Case: Cultural Heritage and NFTs

Italy’s Ministry of Culture has partnered with private companies to use blockchain for art and cultural preservation.

Example: Uffizi Gallery in Florence

The museum launched NFT versions of classical artworks like Botticelli’s The Birth of Venus, recorded on blockchain and sold globally. Proceeds help fund restoration and conservation.

Blockchain Utility:

– Ensures provenance of digital replicas

– Protects copyright and licensing for state-owned works

🚦 Regulation and Compliance

The Italian government, while encouraging innovation, maintains a strong focus on regulatory compliance:

– The 2023 Financial Law includes guidance on crypto asset reporting

– CONSOB and Banca d’Italia oversee blockchain finance to prevent misuse

🔮 Looking Ahead: Future Blockchain Use Cases in Italy

National Digital Identity. Plans are underway to integrate blockchain into Italy’s digital ID system (SPID). This would enable decentralized and self-sovereign identity, putting users in control of their own personal data. Be aware my Italian friends–this could lead to more government control.

Voting and Citizen Engagement. Local governments are exploring blockchain-based voting pilots, especially for expatriate Italians who face challenges in secure remote voting.

Health Records. Better sharing of health data, including vaccination certificates and medical histories.

🌍 Italy’s Role in the EU Blockchain Landscape

As part of the European Blockchain Services Infrastructure (EBSI), Italy contributes to cross-border projects involving:

– Customs and tax compliance

– Academic credential recognition

– Digital business registries

This aligns Italy with the EU’s broader digital transformation goals and strengthens its leadership in public sector blockchain adoption.

🧩 Final Thoughts: Tradition Meets Technology

Italy is proving that blockchain isn’t just for tech startups or financial firms—it’s a foundational technology for transparent, secure, and efficient governance. With well-defined laws, pilot programs, and a collaborative approach, the Italian government is helping set the standard for how blockchain can transform the public sector across Europe.

Time to get back to sight seeing in Milan!

Until next time,

Yogi Nelson