by Yogi Nelson

Welcome to the BlockchainAIForum

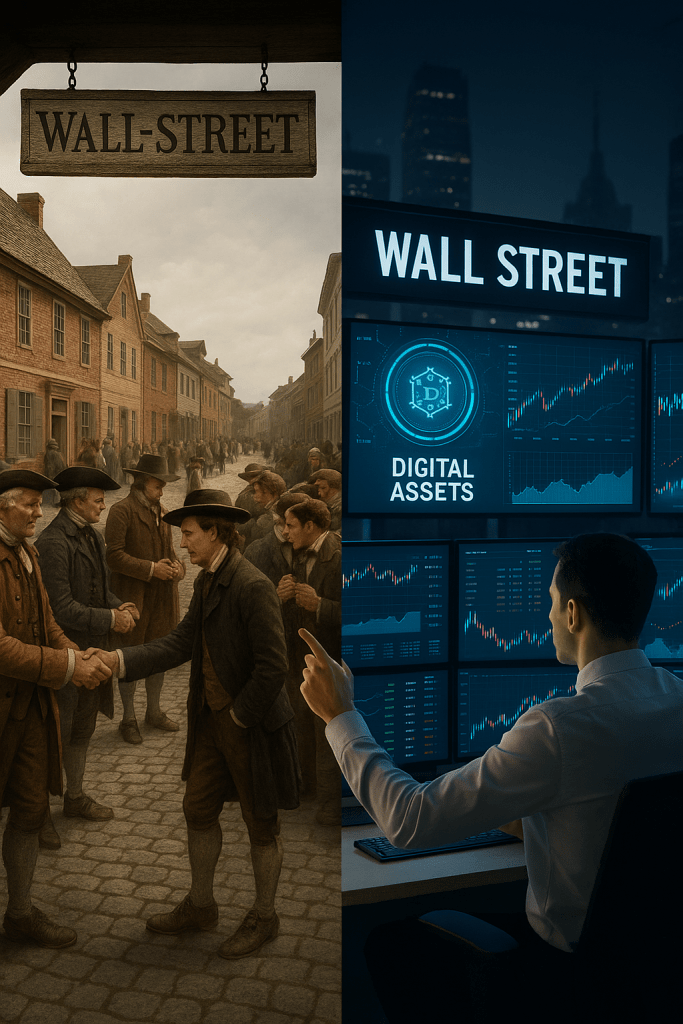

The evolution of money is perpetual. Asset managers, such as Franklin, must constantly evolve our face extinction. Franklin was early to adopt a nascent technology in the 1990’s–the internet. Thirty years later, Franklin remains at the forefront–this time with blockchain. Back in the 1990s, Franklin had an “internet-department” that settled transaction! Eventually, of course, the entire organization adopted the internet. Once again, Franklin and the financial world is experiencing a steady convergence between traditional finance (TradFi) and decentralized finance (DeFi). One of the clearest examples of this integration is Franklin Templeton’s Franklin OnChain U.S. Government Money Fund, commonly referred to as Benji. This pioneering initiative represents one of the first regulated U.S. mutual funds to record shares on a public blockchain. While blockchain has often been associated with volatile cryptocurrencies, Benji shows how the technology can be used to modernize stable, regulated financial products—and potentially reshape how capital markets operate.

What Is Benji?

Benji is Franklin Templeton’s blockchain-based version of its U.S. Government Money Market Fund. Launched in 2021, the fund is registered with the SEC under the Investment Company Act of 1940, just like any other regulated mutual fund. However, what makes Benji unique is where its shareholder records live. Instead of relying exclusively on traditional databases, the fund records ownership on the Stellar blockchain, with secondary support later expanded to Polygon.

At its core, the fund invests in short-term U.S. government securities—Treasury bills, government agency debt, and repurchase agreements backed by these instruments. This means investors are not exposed to crypto volatility. Rather, they are accessing a conservative, low-risk investment vehicle—but one enhanced with blockchain technology.

How It Works

Investors access the fund through the Benji Investments app, a mobile platform that simplifies account opening, management, and transactions. Each share of the fund is represented by a tokenized security on-chain. Behind the scenes, Franklin Templeton continues to act as the fund manager, custodian, and transfer agent—ensuring compliance with existing U.S. regulatory frameworks.

From the investor’s perspective, the workflow is straightforward:

- Onboarding – Investors complete KYC/AML checks just as they would with any regulated investment account.

- Purchase – When buying into the fund, they receive blockchain-based tokens representing their shares.

- Ownership Records – These shares are recorded and verifiable on the Stellar blockchain.

- Liquidity – Investors can redeem their holdings for cash through the app, just as they would with a traditional money market fund.

This hybrid model combines the legal protections of a regulated fund with the transparency and efficiency of blockchain.

Why It Was Created

The motivation behind Benji can be understood on two levels.

1. Modernizing the back office

The traditional asset management industry relies on layers of intermediaries—custodians, transfer agents, clearinghouses, and settlement systems. These processes are expensive and prone to inefficiencies. By recording fund shares on a blockchain, Franklin Templeton seeks to reduce operational friction, automate reconciliation, and lower costs.

2. Bridging traditional and digital finance

As digital assets gain adoption, institutional and retail investors alike want safer ways to access blockchain-powered financial products. A government money market fund offers familiarity and trust, while its on-chain representation allows participation in emerging blockchain ecosystems. This could pave the way for integrating traditional assets into DeFi protocols in a compliant manner.

The Problems Benji Addresses

Benji is designed to solve several persistent challenges in the investment industry:

- Inefficiency in recordkeeping: Traditional fund operations rely on complex reconciliation processes across multiple intermediaries. On-chain records create a single, immutable source of truth.

- Limited transparency: Blockchain enables near real-time visibility into share ownership, increasing trust and reducing the potential for errors or disputes.

- Barriers to access: By packaging the fund into a user-friendly mobile app, Franklin Templeton lowers the threshold for retail investors to participate. Over time, tokenized shares could be integrated into digital wallets and interoperable with other blockchain-based services.

- Liquidity and speed: Traditional settlement cycles can take days. Blockchain-based records allow for faster, more seamless transactions.

Broader Implications

The launch of Benji is not just a technological experiment; it is a signal of how legacy institutions are adapting to the digital age. Several key implications emerge:

- Institutional adoption of blockchain: Benji demonstrates that blockchain is not just for cryptocurrencies, but also for regulated, mainstream financial products.

- Tokenization of real-world assets (RWA): Money market funds are just the beginning. If successful, this model could extend to bonds, equities, real estate, and other asset classes.

- Pathway to DeFi integration: While Benji operates in a regulated framework, the tokenized nature of its shares opens the door for eventual interoperability with decentralized finance applications—potentially unlocking new liquidity and use cases.

- Regulatory precedent: Franklin Templeton’s collaboration with the SEC provides a roadmap for other asset managers interested in bringing funds on-chain while staying compliant.

Conclusion

Franklin Templeton’s Benji is a landmark in the evolution of financial markets. By placing shares of a U.S. government money market fund on a blockchain, it bridges the worlds of traditional investing and decentralized technology. For investors, it offers a conservative, regulated product with the added benefits of efficiency and transparency. For the industry, it represents a proof of concept for how tokenization can address long-standing inefficiencies and unlock new opportunities. As blockchain technology matures, Benji may be remembered not just as an isolated experiment, but as the first step toward a new financial architecture—one where traditional assets and digital infrastructure coexist seamlessly.

Until next time,

Yogi Nelson

Sources:

Franklin Templeton Website.

Securities and Exchange Commission

RWA.xyz.

Stellar Lumens Website