by Yogi Nelson

Welcome to the BlockchainAIForum

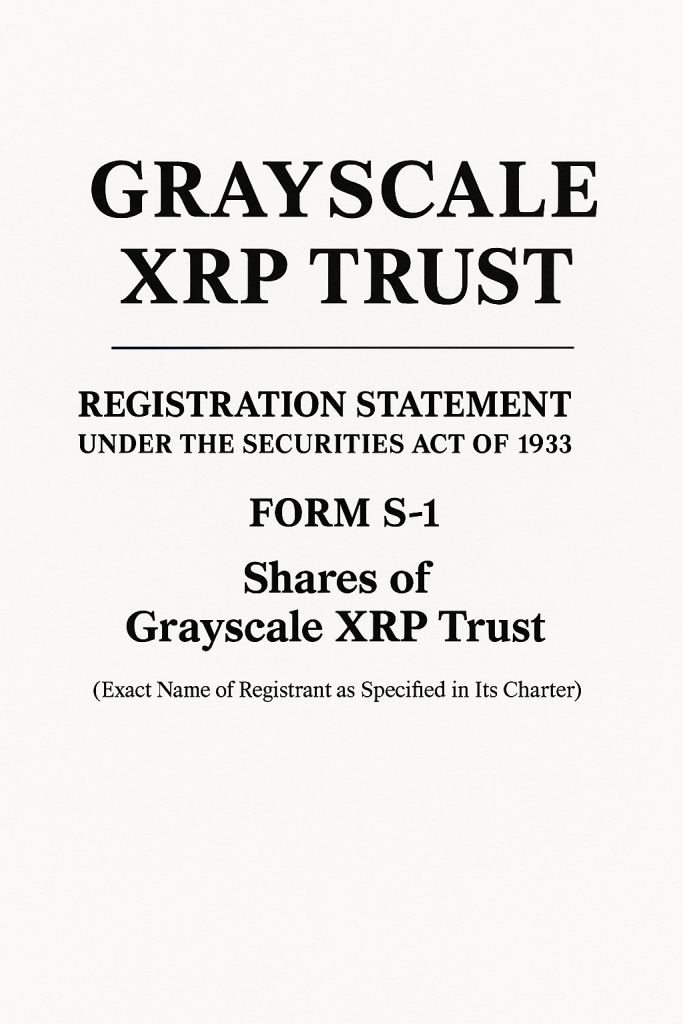

On August 22, 2025, Grayscale filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch the Grayscale XRP Trust ETF. The SEC must decide whether to approve, or deny, Grayscale’s application by October 25th. That makes today a perfect moment to examine Grayscale’s S-1 application. I’ll focus exclusively on the section labeled Management’s Discussion and Analysis of Financial Conditions and Results of Operations. Keep in mind, what you are about to read is based on the representations made by Grayscale management. Let’s dive in!

Management’s Discussion and Analysis (MD&A)

Structure and Purpose of the Trust

Grayscale, says the Trust is a passive investment vehicle designed to hold XRP. Its shares reflect the value of underlying XRP, less fees and liabilities. Furthermore, the Trust has no officers or employees; instead, it is managed by its Sponsor. Shares are issued in “Creation Baskets” and can be redeemed in exchange for XRP. No leverage or derivatives are employed, underscoring its conservative mandate.

Accounting Policies

The Trust applies U.S. GAAP investment company standards, claim Grayscale. Transactions are recorded on a trade-date basis, with realized gains calculated via specific identification. Valuation is derived from the principal market, determined annually and reviewed quarterly, with Coinbase identified as the key trading venue in recent assessments.

Financial Performance

- 2024 Inception Period (Sept–Dec 2024): XRP appreciated from $0.54 to $2.10. Net realized/unrealized gain was $7.27 million, driving net assets to $10.45 million by year-end. Approximately 5.0 million XRP were contributed in connection with Share creations.

- First Half of 2025: XRP rose from $2.10 (Dec 2024) to $2.32 (June 2025). Three-month net gain: $1.26 million; six-month gain: $919,000. Net assets reached $12.89 million by June 30, 2025, reflecting both price appreciation and new XRP contributions.

- Expenses: The only recurring cost is the Sponsor’s Fee, typically settled in XRP. About 100,000 XRP were liquidated for fees in the first half of 2025.

Liquidity and Cash Handling

The Trust does not hold significant cash balances except for temporary settlement of creations and redemptions, reports Grayscale. Its model minimizes exposure to fiat and focuses solely on XRP. The Sponsor absorbs nearly all expenses except for extraordinary costs, preserving predictability for shareholders.

Market Risks and Disclosures

The Trust neither borrows funds nor invests in derivatives. It faces risks primarily from XRP’s price volatility and regulatory uncertainty. Historical data show XRP’s price ranged from $0.50 to $3.29 between September 2024 and June 2025, with an average of $1.89.

Organizational Updates

In January 2025, Grayscale underwent an internal reorganization. Sponsorship shifted to Grayscale Investments Sponsors, LLC (GSIS), a subsidiary of Digital Currency Group. By May 2025, GSIS became the sole Sponsor of the Trust. This change did not materially affect operations.

Business Section

Trust Overview

Formed in Delaware in August 2024, the Trust’s mandate is to provide institutional-grade exposure to XRP. The Trust will trade under the ticker GXRP on NYSE Arca. Shares will be distributed in 10,000-unit “Baskets” to Authorized Participants, which can create or redeem shares in exchange for XRP or cash.

Investment Objective and Arbitrage Mechanism

The ETF aims to mirror the value of XRP held by the Trust, less expenses. The arbitrage mechanism—where Authorized Participants exploit discrepancies between market price and NAV—keeps the share price aligned with underlying XRP value. Shares may still trade at premiums or discounts, particularly during periods of thin liquidity or divergent trading hours between crypto markets and NYSE Arca.

Characteristics of the Shares

- Accessibility & Cost Efficiency: Investors avoid the complexity of direct XRP custody.

- Transparency: Listed on a regulated exchange, prices are visible and liquid.

- Security: XRP holdings are stored in cold storage by Coinbase Custody, using multi-signature, geographically distributed vaults.

- Minimal Credit Risk: The Trust does not lend or rehypothecate assets.

Custody and Security

Coinbase Custody Trust Company, LLC is the exclusive custodian. Keys are stored offline in distributed vaults. Transfers require multiple private key shards and verification protocols, reducing single-point-of-failure risks.

Trust Activities

The Trust’s activities include creating and redeeming shares, disposing of XRP for Sponsor’s fees, and distributing assets upon dissolution. It does not actively manage XRP or attempt to generate profits beyond price tracking.

Incidental Rights and Forks

The Trust has adopted a strict policy of abandoning all incidental rights, forks, or airdrops associated with XRP. This simplifies compliance but means shareholders will not benefit from potential windfalls.

Secondary Market Trading

While NAV is based on an index of five major platforms (Coinbase, Bitstamp, Kraken, Crypto.com, LMAX Digital), shares may trade at premiums/discounts on NYSE Arca due to liquidity gaps and non-overlapping trading hours.

XRP Industry Context

The filing outlines XRP’s origins and use case as a bridge currency for cross-border payments. Key details include:

- Supply: 100 billion XRP were pre-issued; ~59 billion are circulating. Ripple Labs placed 55 billion XRP in escrow to manage supply release.

- Use Case: XRP enables near-instant, low-cost cross-border settlements compared to traditional methods.

- Network Governance: Validation relies on a Trusted Node List, with Ripple Labs running 1 of 35 validators.

- Transaction Fees: Extremely low—0.00001 XRP per transaction—function as spam protection.

Regulatory Environment

The CFTC regulates XRP futures and considers XRP a commodity. The SEC’s stance remains uncertain; a ruling that XRP is a security could dissolve the Trust. In 2025, CME launched XRP futures, subject to heightened CFTC oversight.

Valuation and Index Methodology

NAV is calculated using the CoinDesk Ripple Price Index (XRX), which aggregates volume-weighted prices across exchanges. Methodology emphasizes compliance, liquidity, and AML/KYC adherence. Variances between platforms and the Index have been minimal, averaging less than 1%.

Competitive Differentiation

Grayscale highlights advantages such as institutional-grade custody, transparent methodology, direct XRP ownership, and a competitive fee structure.

Conclusion

Despite challenges such as volatility and regulatory uncertainty, Grayscale has positioned GXRP as a cost-efficient, institutionally secure gateway bridging digital asset markets and traditional securities exchanges, says management. However, investing carries risk, hence do your own research as nothing in this article constitutes financial or investment advice.

Until next time,

Yogi Nelson