by Yogi Nelson

Welcome to the BlockchainAIForum.

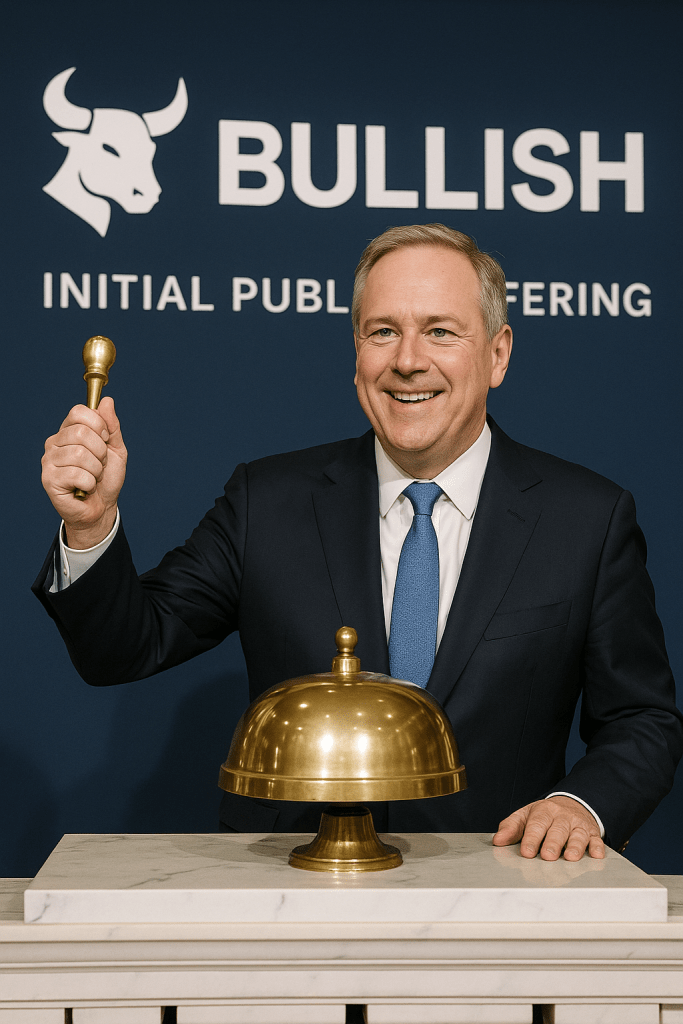

Apparently Summer 2025 is crypto IPO season. Circle’s IPO was a booming success. (Circle issues U.S. backed stable coins.). Will Bullish be bullish or will it fall to the bears. Does it deserve the name Bullish? Or is it too premature to ask or know? As this is not financial or investment advice blog, I suggest you conduct your own independent research. In the mean time, enjoy this article.

Bullish, founded in 2020, is an institutionally focused global digital asset platform that provides trading infrastructure, data services, indices, and media through its core brands: Bullish Exchange and CoinDesk. The company seeks to accelerate adoption of stablecoins, digital assets, and blockchain technology by delivering institutional-grade products backed by compliance, liquidity, and technological innovation. With major acquisitions of CoinDesk (2023) and CCData (2024), Bullish has expanded beyond trading to become a diversified service provider at the intersection of exchanges, financial data, and digital asset media.

Business Overview

Bullish operates two primary divisions:

1. Trading & Liquidity Infrastructure (Bullish Exchange)

– A regulated global exchange for spot, margin, and derivatives trading.

– Licensed in Germany, Hong Kong, and Gibraltar, with U.S. and other jurisdictional approvals pending.

– Features a global order book, institutional-grade liquidity, risk management tools, and subscription-based liquidity/stablecoin services.

– Reported $1.25 trillion+ cumulative trading volume as of March 31, 2025. In 2024, it achieved ~35% and 44% market share in spot trading for Bitcoin and Ethereum respectively among its peer set.

– Average daily trading volume in Q1 2025 reached $2.55B in spot and $248M in perpetual futures.

2. Information Services (CoinDesk)

– Indices: Offers proprietary multi-asset benchmarks (e.g., CoinDesk 20 Index) and reference rates like the long-established Bitcoin Price Index (XBX). Collectively, indices support $31.9B AUM and $14.3B in trading volume (March 2025).

– Data: Provides real-time and historical analytics to over 171,000 professionals, strengthened by CCData’s enhanced market coverage and analytics.

– Media & Events: Operates CoinDesk.com (55M+ unique visitors in 2024), podcasts, newsletters, and social media channels. The flagship Consensus conference drew 26,000+ attendees in 2025 and expanded globally with events in Hong Kong and Toronto.

Together, these lines create a synergistic “flywheel” model: data powers indices, indices generate products listed on the exchange, and media amplifies visibility and customer acquisition. Cross-selling and integration remain central to growth.

Management and Governance

The company is led by CEO Thomas W. Farley, former President of the NYSE, who has extensive experience scaling exchanges and integrating acquisitions at Intercontinental Exchange (ICE). The management team combines expertise across traditional finance, digital assets, and technology.

Bullish is incorporated in the Cayman Islands (2021) and qualifies as a foreign private issuer under U.S. securities law, giving it exemptions from certain SEC reporting, disclosure, and NYSE governance requirements. For example, it is not bound by U.S. proxy rules or insider reporting standards. However, this could mean less transparency compared to U.S.-based peers.

Financial Overview

– 2024 Net Income: $80 million.

– Q1 2025 Net Loss: $349 million, reflecting market volatility and strategic investments.

– Adjusted EBITDA: $52M (FY 2024); $13M (Q1 2025).

– Liquid Assets (March 2025): $1.96B, consisting of $1.73B Bitcoin, $144M stablecoins, $28M cash, $22M ETH, and $33M other tokens. Borrowings totaled $551M.

Bullish emphasizes a conservative treasury strategy to ensure resilience across digital asset price cycles while maintaining flexibility for acquisitions and growth initiatives.

Preliminary Q2 2025 estimates were included, showing continued volatility. Adjusted transaction revenue, adjusted EBITDA, and net income figures were disclosed as non-IFRS guidance but subject to revisions upon final audit.

Market Context and Growth Opportunity

Bullish sees digital assets at an early adoption stage, akin to the internet in the 1990s. Bullish argues it is well positioned to capture value across this multi-trillion-dollar addressable market through its integrated services. By mid-2025, the global digital asset market reached $3.4 trillion in capitalization with 17,000+ cryptocurrencies in circulation. Positive industry trends include:

– Rising Market Activity: Bitcoin and Ethereum trading volumes surged in late 2024, and wallet adoption doubled between 2022 and 2024.

– Institutional Adoption: Firms such as BlackRock, Fidelity, and Goldman Sachs have entered the sector, with Bitcoin and Ethereum exchange-traded products attracting $44B+ inflows by mid-2025.

– Regulatory Clarity: Frameworks such as the EU’s MiCA, U.S. approval of spot BTC and ETH ETFs, and the U.S. GENIUS Act for stablecoins provide legitimacy and growth opportunities.

– Technological Advancements: Rapid adoption of stablecoins (>$250B market cap), tokenization, DeFi, and blockchain-based collateral are expanding applications, with projections of $1.6T–$3.7T stablecoin supply by 2030.

Competitive Advantages

Bullish highlights several differentiators in its IPO filing:

1. Comprehensive Product Suite: Unified cross-collateralized margin accounts, deep liquidity, and seamless trading infrastructure.

2. Diversified Business Lines: Exchange, data, indices, and media provide multiple revenue streams and reduce volatility.

3. Trust and Compliance: Operates regulated platforms and maintains transparent governance.

4. Technology Leadership: High-performance central limit order book and automated market-making; continuous upgrades to security, scalability, and user experience.

5. Global Reach: Strong institutional presence with 36% YoY client growth in 2024; CoinDesk’s global audience bolsters customer acquisition.

6. Capital Strength: $1.9B+ in digital assets available to support liquidity and expansion.

7. Experienced Leadership: Proven track record in scaling and integrating exchanges.

Growth Strategy

Bullish plans to drive expansion through five main levers:

– Licensing Footprint Expansion: Actively pursuing U.S., UK, Canadian, and EU approvals, with multiple state money transmitter licenses already secured.

– Product Innovation: Continuously launching new trading products (e.g., perpetual futures, indices) and cross-selling into existing customers.

– Vertical Integration & Collaboration: Cross-leveraging exchange, data, and media businesses to maximize synergies.

– Customer Base Expansion: Moving beyond institutional clients to target active traders (“prosumers”), using CoinDesk’s reach for cost-effective customer acquisition.

– Strategic M&A: Future acquisitions will focus on scaling exchange operations, new product development, and geographic expansion, building on the successful integration of CoinDesk and CCData.

Risks and Challenges

Bullish identifies multiple risks that investors should weigh:

– Regulatory Uncertainty: Digital assets remain under evolving global regulatory scrutiny, which may limit innovation or expansion.

– Intense Competition: Competes with both regulated and unregulated platforms, including DeFi, DEXs, and DAOs that may innovate faster.

– Volatility in Results: Dependent on adoption rates and price swings of digital assets, which drive trading activity and revenues.

– Operational & Security Risks: Potential loss or mismanagement of private keys, cyberattacks, or system disruptions could harm reputation and operations.

– Conflicts of Interest: Ownership of CoinDesk as both a news source and business line presents reputational risks.

– Dependence on Third Parties: Reliance on external banking, insurance, and service providers introduces vulnerabilities.

– Jurisdictional Complexity: Operating in multiple countries creates compliance risks.

– Foreign Private Issuer Risks: Exemption from U.S. governance standards may mean less disclosure and oversight than domestic peers.

– Geopolitical Factors: PRC oversight of Hong Kong, U.S. HFCAA rules, and other geopolitical risks could negatively affect operations or share value.

Conclusion

Bullish positions itself as a next-generation, diversified digital asset leader at the intersection of trading, data, and media. The company has grown rapidly, securing a top-10 position in Bitcoin and Ethereum spot trading, while also building out indices, analytics, and globally recognized events like Consensus. With strong leadership, $1.9B in liquid assets, and a synergistic operating model, Bullish believes it is uniquely positioned to capture growth in the expanding digital assets sector.

However, the IPO also comes with significant risks: regulatory uncertainty, industry volatility, fierce competition, and governance exemptions tied to its foreign private issuer status. Investors are cautioned that while Bullish’s strategy shows promise, its results may remain volatile as the digital asset industry continues to evolve.

Until Next Time,

Yogi Nelson

Very well-written and balanced take, Yogi — you covered both the growth potential and the governance caveats perfectly. What stands out most is Bullish’s integrated “flywheel” of exchange, data, and media — that’s a strategic edge few others can replicate. With institutional adoption rising, projects that merge liquidity and transparency could define the next bull run.

I’ve been exploring similar blockchain-based innovations on cryptoflash2.com, especially around real-time liquidity and asset movement — it’s fascinating to see how fast this space is evolving! 🚀

LikeLiked by 1 person