Welcome to the BlockchainAIForum

by Yogi Nelson

🔍 What Is Proof of Reserves?

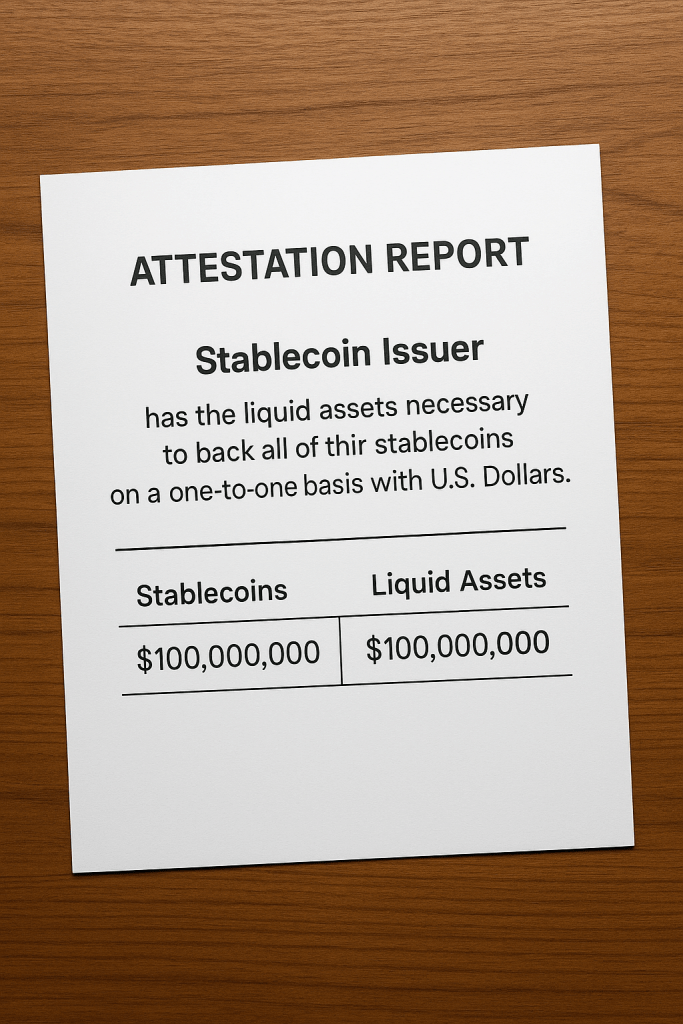

Proof of Reserves (PoR) is a method used by crypto platforms—especially those holding customer funds, like exchanges and stablecoin issuers—to publicly demonstrate that they actually possess the assets they claim to hold. At its core, PoR is a transparency mechanism. It allows users to verify that a custodian or exchange has sufficient reserves to match its liabilities (user deposits).

Example:

If a crypto exchange claims to hold 10,000 BTC on behalf of users, PoR should allow anyone to independently confirm that those 10,000 BTC exist and are not being rehypothecated or loaned out irresponsibly.

🛠️ How Proof of Reserves Works Today: Step-by-Step

- Snapshot of Liabilities

The platform takes a cryptographic snapshot of its liabilities—i.e., user account balances—using a Merkle Tree to protect user privacy. - Auditor Verification

A third-party auditor verifies that wallet balances match the claimed reserves, both on-chain and off-chain (e.g., fiat). - Merkle Proof for Users

Users can verify their individual balances were included, without seeing anyone else’s data. - Public Publication

The proof and auditor certification are published online, for full transparency.

🧠 Enter the Genius Act: What Just Changed?

In 2025, President Trump signed into law the Genius Act (Guiding the Establishment of Neutral, Independent, and Uniform Standards for Stablecoins). It is the first federal stablecoin law in the United States and sets enforceable guidelines for Proof of Reserves.

Key Provisions:

- ✅ Mandatory monthly PoR audits for stablecoin issuers

- ✅ Auditors must register with the Fed or OCC

- ✅ Support for smart contract-based reporting

- ✅ Consumer-facing transparency dashboards

- ✅ Criminal penalties for reserve misreporting

🔄 How Proof of Reserves Will Evolve Post-Genius Act

1️⃣ Smart Contracts Will Automate Reporting. Stablecoin issuers will publish reserve data in real-time via on-chain smart contracts. No more waiting for PDF reports every 30 days.

2️⃣ Standardized API Interfaces. Federal APIs will allow anyone—developers, researchers, users—to access reserve data across all compliant stablecoins in the same format.

3️⃣ Integration with FedNow and CBDCs. Expect PoR frameworks to integrate with real-time payments infrastructure like FedNow, and eventually with central bank digital currencies.

4️⃣ Auditor Decentralization via zk-Proofs. Zero-knowledge proof systems will offer privacy-preserving audit alternatives. Platforms can prove solvency without exposing sensitive business data.

5️⃣ Penalties Add Teeth to Transparency. Unlike the pre-2022 era of voluntary disclosure, the Genius Act enforces real penalties—including jail time—for false or misleading PoR claims.

🧩 Why This Matters for Users and Developers

- 🔐 Greater Trust: Real-time proof builds credibility.

- 📈 Mass Adoption: Retail and institutional users feel safer.

- 💻 Better UX: Wallets and apps can display verified reserve info.

- 🏛️ Regulatory Clarity: Clear rules mean better innovation pathways.

🚀 Final Thoughts: Proof of Reserves Grows Up

Proof of Reserves began as a “nice to have” for ethical exchanges. Thanks to the Genius Act, it is becoming the legal standard and a foundation for U.S.-based stablecoins.

Expect:

- 🔄 Continuous, on-chain reserve reporting

- 📊 Unified federal dashboards

- 🔍 Fewer excuses for hidden risks

Would you trust a bank that never showed you its vault? With PoR 2.0 under the Genius Act, now you don’t have to.

Until Next Time,

Yogi Nelson