What Is the GENIUS Act?

Blockchain & AI Forum — June 2025

By Yogi Nelson

Welcome to the Blockchain & AI Forum, where your questions are answered!

As a bonus, every post includes a proverb from around the world.

Today’s question comes from Latasha, who asks: What is the GENIUS Act?

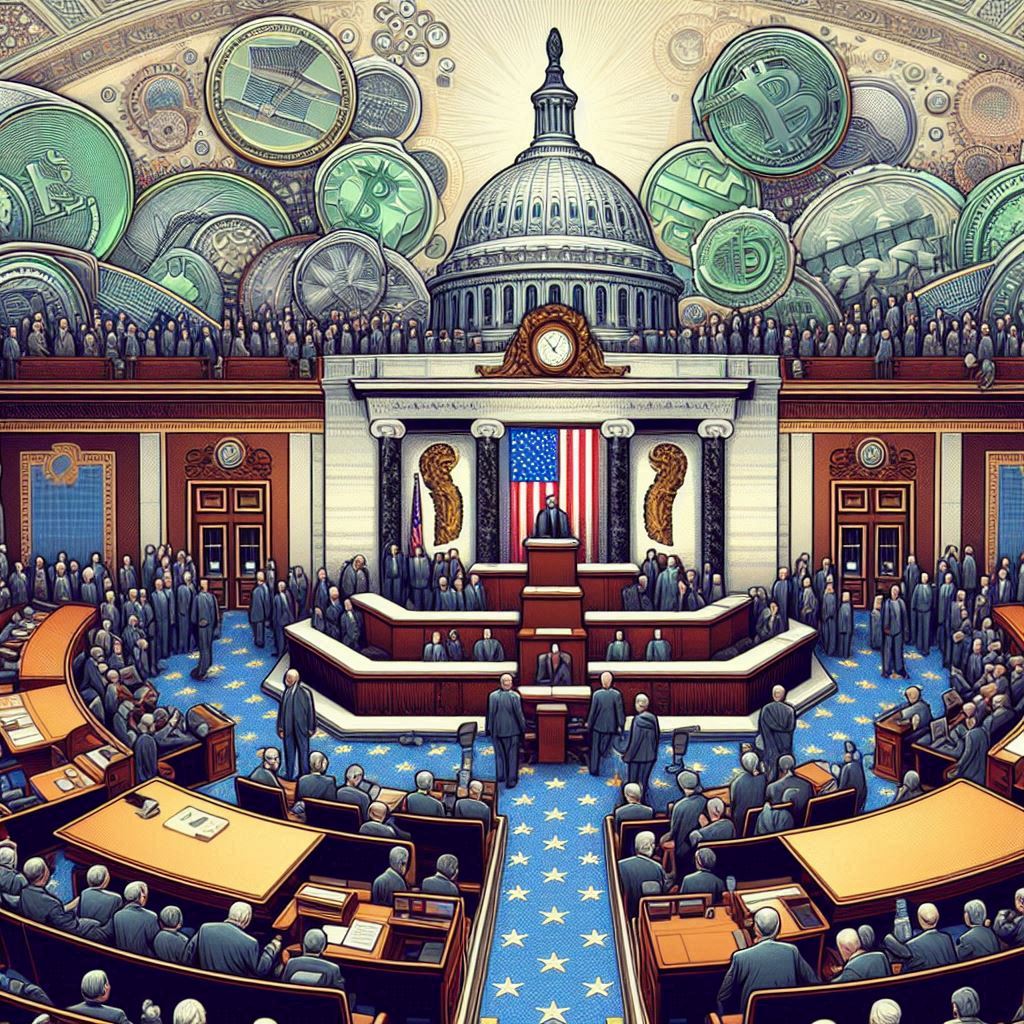

🔍 Overview

The GENIUS Act has been approved by the U.S. Senate! It was introduced by Senator Bill Hagerty of Tennessee, your home state. As expected, GENIUS is an acronym:

“Guiding and Establishing National Innovation for U.S. Stablecoins, 2025.”

Let’s walk through what this bill says—section by section—and what it could mean for stablecoin issuers, regulators, and the future of U.S. digital finance.

📘 Key Definitions

GENIUS defines 23 terms, but none more important than this one:

Payment Stablecoin: A digital asset designed for payments or settlement. The issuer must maintain a fixed redemption value (e.g., 1:1 with the U.S. dollar) and is required to redeem, repurchase, or convert the token on demand. It is not a national currency or a security.

🏛️ Who Can Issue Stablecoins?

If GENIUS becomes law, (waiting for the House of Representatives and the President to act) only permitted stablecoin issuers may issue payment stablecoins. That means:

No freelancers. No startups cutting corners.

If you’re unauthorized—you’re out. Or worse, facing federal prison time. 🫢

🧾 Requirements for Issuing Stablecoins

Issuers must:

- Maintain 1:1 Liquid Reserves

Reserves must include:- U.S. dollars

- Bank demand deposits

- Treasury bills, notes, or bonds (≤ 93 days)

- Short-term repurchase agreements (≤ 7 days)

- Money market funds

- Federal Reserve deposits

- Ensure Transparency

- Disclose redemption policies

- Publish monthly reserve composition

- Establish clear redemption procedures

- Certify Compliance Monthly

- Signed certifications by both CEO and CFO

What Stablecoin Issuers Can Do

Issuers are restricted to these activities:

- Issue and redeem stablecoins

- Manage reserves

- Provide custodial or safekeeping services

- Engage in directly related activities

No off-brand ventures allowed.

🏢 Who Will Regulate?

Good news: no new federal agency will be created. Oversight will remain with existing regulators:

- National Banks: Supervised by the OCC (Office of the Comptroller of the Currency)

- FDIC-Insured Banks: Supervised by the FDIC

- State-Chartered Banks: Must follow GENISIS via state regulators

- Qualified Nonbanks: Regulated by the OCC

This streamlined approach avoids regulatory overlap and confusion.

📄 Application & Approval Process

Once an application is deemed complete, regulators have 120 days to approve or deny.

The Catch:

The 120-day clock doesn’t start until the regulator says the application is complete. A hostile regulator could delay indefinitely by asking for more documents.

If the application is rejected, the regulator must:

“Explain all findings related to material shortcomings and offer actionable recommendations for improvement.”

My Take:

This is unusual—and potentially risky. It effectively requires regulators to teach applicants how to qualify. That raises a key question:

If an applicant can’t complete a solid application, can they really run a stablecoin program? 🤔

And if the program later fails, will they blame the regulator for “bad tutoring”?

⚖️ Rulemaking Timeline

GENIUS includes a standard Rulemaking section.

Congress gives agencies 180 days from enactment to issue final regulations.

🏁 In other words: regulators, start your engines.

🌍 Proverb of the Day

Before I head out, here’s your bonus proverb:

🐻 “A hungry bear does not dance.”

– Turkish Proverb

Until next time,

– Yogi Nelson

Blockchain & AI Forum